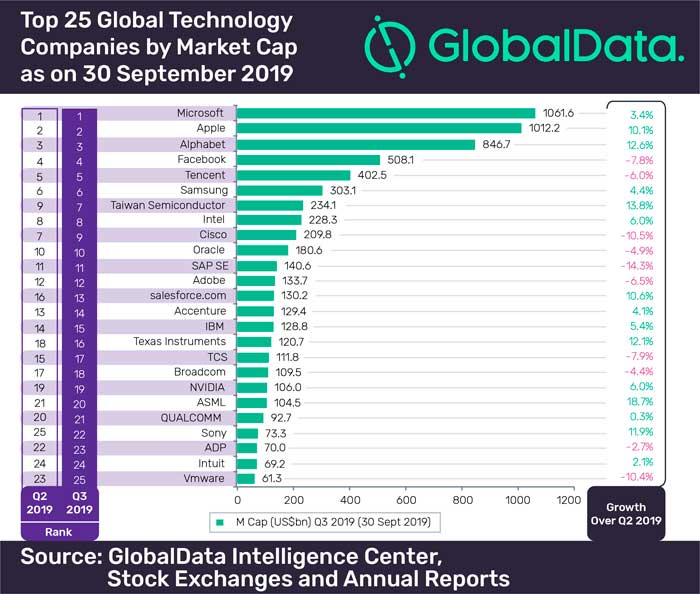

Majority (15) of the companies in the GlobalData’s list of top 25 publicly traded global technology* companies by market capitalization (M Cap) reported quarter-on-quarter (QoQ) growth in the third quarter (Q3) ended 30 September 2019, with Dutch semiconductor company ASML reporting 18.7% growth during the period, according to GlobalData, a leading data and analytics company.

Majority (15) of the companies in the GlobalData’s list of top 25 publicly traded global technology* companies by market capitalization (M Cap) reported quarter-on-quarter (QoQ) growth in the third quarter (Q3) ended 30 September 2019, with Dutch semiconductor company ASML reporting 18.7% growth during the period, according to GlobalData, a leading data and analytics company.

The ranking of the top 12 companies remained unchanged, except for Taiwan Semiconductor and Cisco Systems swapping their places at seventh and ninth positions.

The overall list witnessed a QoQ growth of 2.9% in the aggregate M Cap from US$6.4 trillion to US$6.6 trillion. Major gainers Alphabet, Apple, Taiwan Semiconductor, salesforce.com, Texas Instruments, ASML and Sony recorded more than 10% increase in M Cap. This growth consequently improved the ranking of salesforce.com, Texas Instruments, ASML and Sony to 13th, 16th, 20th and 22nd, respectively, in Q3 2019 from 16th, 18th, 21st and 25th, respectively, in Q2 2019.

Keshav Kumar Jha, Company Profiles Analyst at GlobalData, comments: “Alphabet’s share price increased from US$1,082.8 in Q2 2019 to US$1,221.14 in Q3 2019 as a result of an increase in revenue in Q2 2019. The revenue growth was fueled by product enhancements in its core offerings including Search, Maps, YouTube and the Google Assistant; and expansion of cloud and hardware offerings. The new breakthroughs in artificial intelligence (AI) also fueled the demand for Alphabet stock.”

Apple’s M Cap accelerated to over US$1 trillion in Q3 2019 on the back of strong performance of iPad and Mac segments, and the launch of new iPhone 11, iPhone 11 Pro, the new iPad, Apple Watch Series 5 and iOS 13.

Taiwan Semiconductor’s M Cap growth was a result of stock price increase from US$39.17 in Q2 2019 to US$46.48 in Q3 2019.

Jha explains: “Advancement of 5G deployment, launch of new premium smartphones, increase in the adoption of 7-nanometer solutions and forecasted positive Q3 business outlook by management boosted investors’ confidence. This allowed Taiwan Semiconductor to climb two positions to 7th in Q3 2019.”

Salesforce.com reported M Cap growth on the back of better than anticipated revenue and synergic effect from its acquisitions of Tableau Software Inc., and ClickSoftware Technologies Ltd.

Among the top 10, Cisco Systems, Facebook, Tencent Holdings and Oracle reported M Cap decline of 10.5%, 7.8%, 6% and 4.9%, respectively. Despite the decline in M Cap, Facebook, Tencent Holdings and Oracle were able to hold on to their positions, whereas Cisco Systems dropped from 7th to 9th position.

Cisco Systems’ stock price dropped from US$54.73 to US$49.41 as a result of profit decline witnessed in Q2 2019, and weak revenue projected for Q3 2019 on the back of slowdown in tech enterprise spending due to the ongoing US-China trade war.

Facebook’s stock price decreased from US$193 to US$178.08 with the projected slowdown in revenue growth for Q3 2019, which is expected to continue into 2020, at the back of ad targeting related uncertainties and headwinds including General Data Protection Regulation (GDPR) implementation and its own product changes to focus on privacy. In addition, decreasing margins and decline in new user additions affected investor’s confidence.

Jha concludes: “Going forward, tech stocks are likely to get impacted with the rapid changes in technologies, industry dynamics, digital transformations, cyber security risks, growing competition, and changing data privacy laws and regulations. Furthermore, the global economic slowdown and ongoing US-China trade war can impact stocks as 72% of the top 25 tech companies are headquartered in both the countries.”

*Technology companies include software and hardware developers, IT services providers (including Internet-based services providers), and electronics manufacturers including semiconductors, mobile devices etc.