Although the Internet of Things has received a lot of news coverage as of late, the practice of adding connectivity to machines is nothing new. Network operators have been offering GSM-based connectivity modules for many years, and cellular connectivity has a proven track record of success across a wide range of applications. What makes the Internet of Things revolutionary is not the idea of device connectivity itself, but its widespread application. In the very same way, LTE stands to revolutionize IoT not in essence, but in scale. LTE’s low cost, low bandwidth, and low power consumption will allow for IoT applications which were either not possible, or not economically viable, in the past. And with the number of internet-connected devices projected to reach over 50 billion by 20201, LTE is likely to become a definitive technology in the development of the Internet of Things.

But for product creators currently deploying solutions based on legacy networks, the jump to LTE involves both opportunity and risk. In the race to implement (and define) the future of LTE, countries, carriers, and hardware manufacturers have embraced a variety of different cellular technologies and bands. As a result, the LTE landscape has grown increasingly fragmented and complex.

Despite these challenges, the transition to LTE appears all but inevitable. Therefore, the onus has fallen largely upon product creators to take flexible, strategic approaches future-proof their IoT devices.

The Future of Cellular

Sending data wirelessly is fundamental to IoT applications. It has been ever since the very first 2G cellular modules were added to assets to help reduce servicing costs. The data received could include things like stock levels (in vending machines), evidence of tampering (in payment kiosks), or hours of use (in manufacturing equipment). Data could also include simple functions such as taking an asset in or out of service, alerting an operator that a fault had been reported, or delivering over-the-air updates.

As the roll-out of LTE networks continues, a much wider range of applications will become possible. Applications with more varied data demands, such as video, audio and control telemetry, will drive demand for more connections that are reliable, flexible and power efficient.

Today, many IoT devices are deployed in remote locations and depend on battery power to operate. These distributed applications require much more power-efficient chipsets and modules, but relatively modest bandwidth requirements. Here, too, LTE holds the key to connectivity.

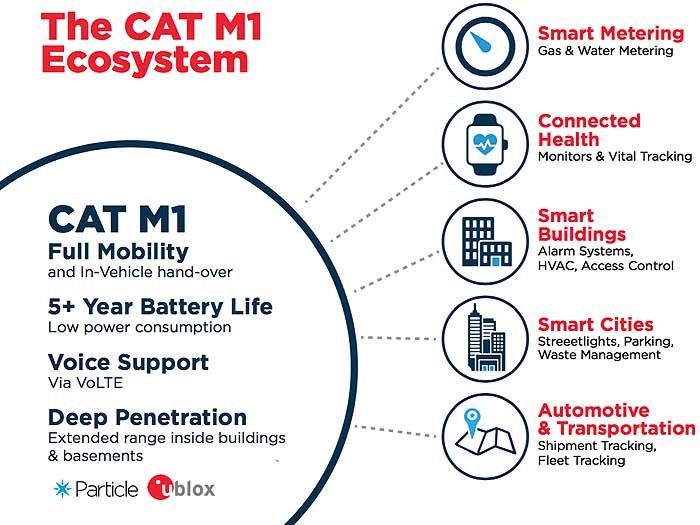

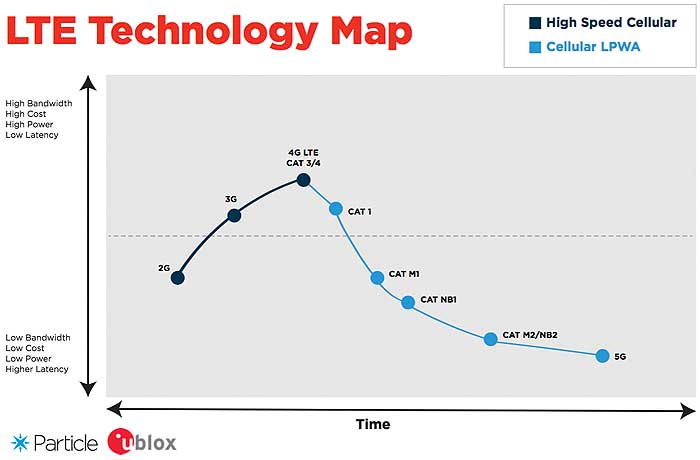

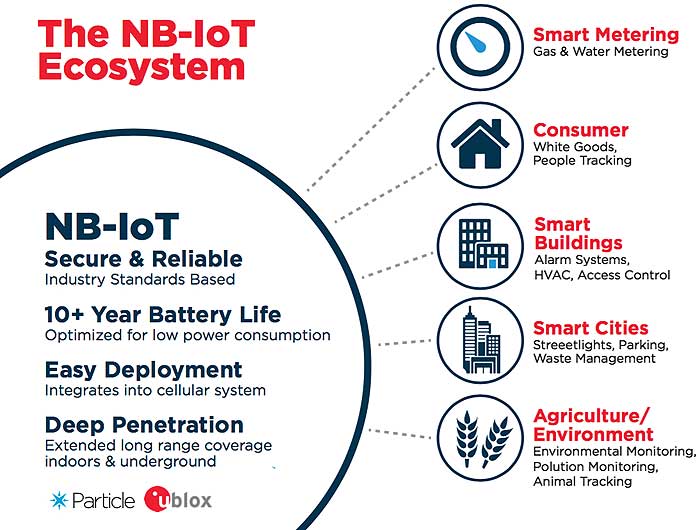

Currently, LTE is being positioned to support IoT applications by dedicating ‘resource blocks’ to low-bandwidth IoT traffic, through what are referred to as “Categories”. Most notably, IoT will employ LTE Category M1 for Machine-Type Communications (known as LTE-MTC, LTE-M or LTE Cat M1), as well as NB-LTE-M and NB-IoT (NB stands for Narrowband).

The categories targeting IoT traffic require significantly less complex chipsets, which means two things — lower operating power (enabling ultra-low power nodes such as smart sensors and actuators), and lower cost (allowing for a wider and more diverse range of applications). Part of the way this is achieved is through using lower (in terms of 3G) bandwidths, which makes them even better suited to IoT applications in which data exchange is limited.

Fragmentation in the Cellular Landscape

Product creators first getting started with cellular connectivity face several formidable obstacles. The cellular landscape, which was historically simplified by roaming agreements and fixed sets of supported bands, is set to become much more complicated with LTE. Product creators will have to contend with the planned (but not always publicly revealed) retirement of existing 2G/3G networks, as well as the international fragmentation of LTE standards and bands.

Many, but not all, carriers have already announced plans to retire their 2G networks within a decade. And as more investment capital is directed toward LTE, the future of 3G networks has also come into question.

At the same time, operators are facing challenges of their own in the way of customer retention. Supporting customers moving to LTE will involve understanding the complex relationship between chipset vendors, module makers and carriers.

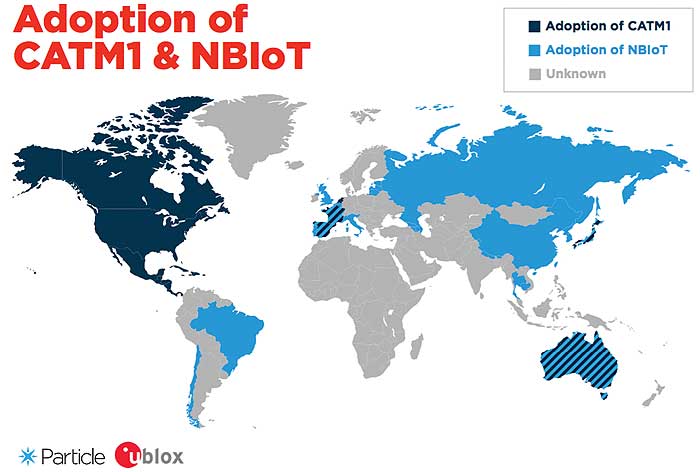

The cellular landscape has always been subject to (and complicated by) regional variations; and, unfortunately, that is unlikely to change with LTE. In the past, product creators have been able to rely on roaming agreements for international compatibility. With the advent of LTE, however, fragmentation in the bands used by various carriers will render these types of roaming agreements impossible. Some are seeing this as a sign that product creators may need to start serving as their own MVNOs (Mobile Virtual Network Operators) and establish place direct agreements with carriers. Far from fueling innovation, these issues may prove to be discouraging, or outright debilitating, barriers to market entry. Each carrier agreement could take many months to negotiate and be subject to its own terms of service, pricing, and data volumes. Reselling this as a service will present further challenges for manufacturers acting as MVNOs.

Some enterprising companies are addressing this emerging problem, by creating IoT platforms that take the burden of connectivity off of product creators. These platforms aim to combine the advantages of MVNOs with the resourcefulness of cloud-based service providers.

International Product Complexity

In the field of cellular communications, there’s never just one, universal standard. This has caused product creators lots of headaches over the years, but in the case of LTE for IoT, the lack of a gold standard may be justified. That’s because neither LTE-M or NB-IoT can be supported seamlessly. Migrating to the former will require a software upgrade to existing cellular towers, while the latter will require a software upgrade and new radio hardware. These realities will only serve to further divide carriers along geographic and technological borders. In the U.S., Canada and Mexico, for example, LTE-M1 has become the norm. Meanwhile in Europe, China, and Southeast Asia, NB-IoT is favored. For product creators wanting to sell in multiple markets, these inconsistencies will require the production of either two product ranges, or a product range that can support both categories. Either way manufacturers will incur additional costs.

The Advent of eSim

Another innovation that is expected to impact MVNOs, is the embedded SIM (eSIM). Put simply, an eSIM allows hardware to be carrier-neutral, enabling the hardware to be switched in the field or provisioned after shipping. Some in the industry believe the eSIM will help build cooperation between MVNOs and thereby improve supply-chain efficiencies.

The eSIM is expected to be integral in the global roll-out of LTE-IoT devices, as it will allow products to be shipped with ‘blank’ SIMs that can then be activated in the country of destination. This will make it easier for product creators to develop and offer new products in different market segments.

The Reality of LTE

The types of applications currently being targeted by LTE-M and NB-IoT developers are sensors and actuators; devices that will require low data bandwidth and, potentially, low duty-cycles. This has led to the widespread misconception that smart sensors and actuators will be able to operate for many years on a single cell. In reality, the longevity of remotely deployed smart sensors and actuators will depend upon the requirements of the specific use case. See the infographic below for a typical use case.

Managing Risk and Reward

Chipset and module manufacturers are now working closely with platform providers to harness the potential of LTE for IoT. Despite the complexities associated with LTE, forward-thinking product design and stack selection can mitigate the risks associated with product development and increase ROI. To future proof IoT products, creators must consider hardware solutions, eSIM, and MVNO/Data platforms.

Understanding the limitations of hardware is critical. For example, a dual-mode modem may seem like the best option for global coverage in single product range, but it will likely add a great deal of unnecessary cost. A better approach would be to adopt a module that offers footprint/pin-out and software compatibility for all variants. That way, a single product design can be used across a variety of markets by simply swapping modules. (See Figure 1).

To overcome the costs and challenges associated with complex roaming agreements, some product creators are now turning to a novel alternative— third-party IoT/MVNO platforms. These platforms are making implementation easier for product creators by eliminating the need to negotiate carrier agreements across an increasingly complex global market.

IoT/MVNO platforms built on dedicated hardware are proving to be invaluable means for product creators to get their projects to market and scale more easily. These platforms provide the infrastructure required to transmit, manage, and protect data all the way from device to cloud.

Conclusion

There is a long history of using cellular modules to add connectivity to assets. But in the past, economic and technological limitations have made the widespread application of cellular connectivity unfeasible. LTE technology — due to its low cost, bandwidth, and energy consumption — stands to remove those barriers, and make possible a multitude of new and innovative IoT applications.

However, the road to that new reality is not without its challenges. Market fragmentation caused by the global adoption of many different technologies and bands has already significantly complicated the transition to LTE. And as the roll-out progresses, new, unforeseen challenges are likely to emerge. For example, a key incompatibility between Radio System Software created by Huawei and Ericsson has already threatened the future of NB-IoT — the technology which has been chosen by European Carriers for IoT2.

Within this landscape, solutions such as eSIMs, footprint/pin-out and software compatible cellular modules, and full-stack IoT/MVNO platforms seek to provide flexibility in the face of uncertainty.

About the authors:

Patty Felts

Patty Felts

Principal Product Manager – Product Strategy, Cellular, u-blox Americas

Patty Felts became Principal Product Manager for u-blox in March 2017 and is responsible for the LTE Cat M1

(R4 Series) product portfolio. Previously, she acted as Director Product Management, PMP, at

u-blox San Diego for nearly five years. Patty holds a Bachelor of Chemical Engineering from Georgia Institute of Technology and a Master of Business Administration (MBA) from St. Edward’s University.

Will Hart

Will Hart

General Manager, Developer Tools, Particle

Will serves as the General Manager for Developer Tools and has spent over four years at Particle bringing IoT solutions from initial prototype to mass production. He oversees Particle’s supply chain and developer tools ecosystem, and is responsible for taking all new concepts and prototypes through rigorous production engineering, quality assurance testing, and final assembly. He also manages Particle’s components, manufacturing relationships, and distribution logistics to meet the high demand for Particle’s innovative products. He has a B.E. in Mechanical Engineering from the Thayer School of Engineering at Dartmouth College.

Sources:

1.) www.cisco.com/c/dam/en_us/about/ac79/docs/innov/IoT_IBSG_0411FINAL.pdf

2.) www.lightreading.com/iot/nb-iot/ericsson-huawei-incompatibility-threatens-nb-iot—sources/d/d-id/732345

u-blox

www.u-blox.com