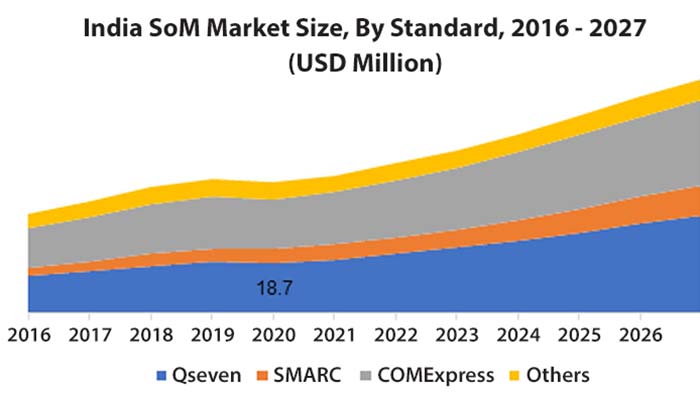

SGET commands more than 50% of the total Computer-on-Module market with Qseven and SMARC. For credit-card-sized modules, this share rises to over 95%. (Source: www.gminsights.com)

The Standardization Group for Embedded Technologies e.V. (SGET) was established in 2012 by founding members Advantech, congatec, Data Modul, Kontron, MSC, and SECO. Today, the standardization body has grown to over 50 members and hosts the world’s leading small form factor (SFF) specifications, which provide embedded computing designers with tremendous additional value.

SGET was created to advance the standardization of embedded technologies in line with evolving market needs, and to develop global embedded computing specifications. An important initial goal was to move beyond x86-centric standards and unify the worlds of ARM and x86 application processors – a challenge no other standardization body wanted to take on. However, the market demanded such standards. After all, low-cost tablet processors were emerging at the time and x86 processors were losing their dominance in the low-power sector. Today, it’s clear this was the right path, as ARM processors have significantly grown their market share over x86, especially in low-power mobile applications. ARM now holds over 50% market share in the module sector.[i] In hindsight, creating a Computer-on-Module (COM) standard for both ARM and x86 was a wise decision.

Qseven has become the market leader in credit-card-sized COMs

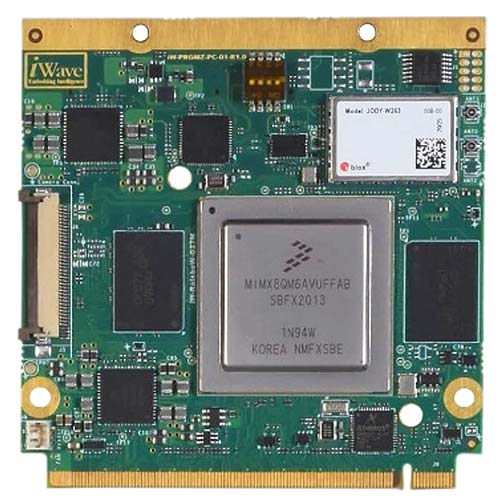

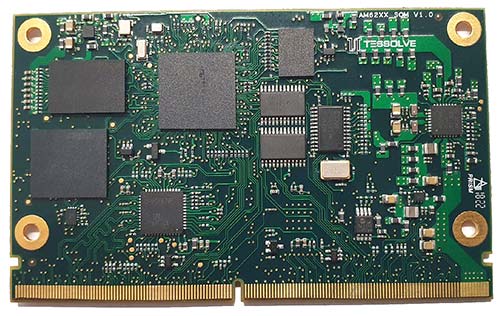

SGET has been responsible for the Qseven (70 mm x 70 mm) and SMARC (82 mm x 50 mm) form factor standards since 2013. (© Tessolve / © iWave)

The first manufacturer-agnostic Computer-on-Module standard hosted by SGET is the Qseven specification. Originally conceived by congatec in 2008 and adapted by companies such as Kontron, the standard was transferred to the Qseven consortium before SGET took over official hosting duties in 2013 after the consortium was dissolved. Qseven modules feature a standardized 70 mm x 70 mm (Qseven) or 40 mm x 70 mm (µQseven) form factor and a standardized pin assignment via a high-speed MXM connector. According to a 2021 study by Global Market Insights, the Qseven standard is extremely successful, holding over 35% market share of the total module sector.[ii] Future prospects also look highly promising if you believe analysts such as Astute Analytica, who predict Qseven will continue to grow faster than other  form factor standards.[iii] SGET, on the other hand, anticipates that new designs will shift toward smaller form factors and expects future sales to come primarily from existing customers.

form factor standards.[iii] SGET, on the other hand, anticipates that new designs will shift toward smaller form factors and expects future sales to come primarily from existing customers.

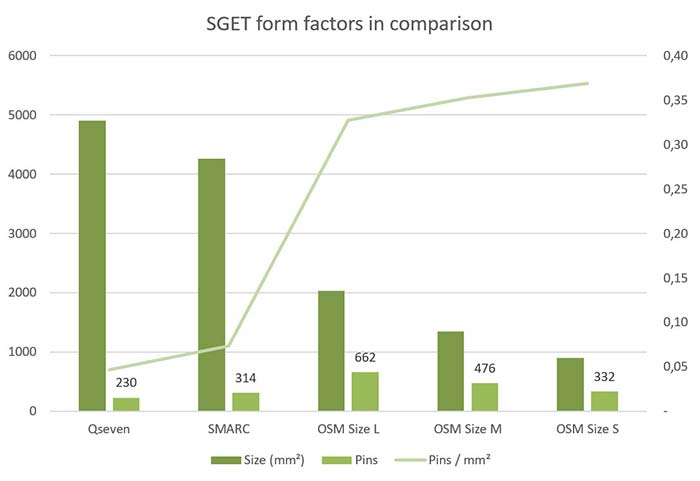

SMARC shrinks size and increases density

SMARC, the second Computer-on-Module standard hosted by SGET, is also very successful. At 82 mm x 50 mm, SMARC modules are more compact than Qseven yet offer 35% more connectivity with 314 pins vs 230 pins for Qseven. This makes SMARC especially interesting for developers of more complex system designs for whom the combination of increasingly smaller footprints with higher packing density is highly appealing. The only drawback is probably the fact that SMARC entered the market much later than Qseven. Follow-on standards tend to struggle while the older standard still offers adequate features. Developers remain loyal to their form factors for years. Why keep reinventing the wheel and reinvest in R&D when the chosen standard works? Nevertheless, SMARC has carved a share of over 15% of the total Computer-on-Module market since its arrival in 2013.[iv] Industry insiders expect that SMARC will become the preferred choice for new designs given its more modern and capable technical basis. However, it will be some time before the main market share shifts to SMARC. Notably, Kontron played a leading role in developing the SMARC standard, which was also officially launched by SGET in 2013.

The new OSM standard offers all the advantages of COMs, plus support for SMT assembly. The latter provides additional cost savings, primarily for packing, assembly, and testing in high-volume production. (Pictured here is the back of a module with NXP i.MX8M processor.) © Kontron

SGET standards dominate SFF sector

Together, the two SGET standards account for over 50% of the total Computer-on-Module market. For small form factor modules in the low-power range, their combined market share likely approaches 95%, as the only other comparable Computer-on-Module standard (COM Express Mini) tends to be overshadowed by its larger counterparts. Achieving such success and virtually dominating the entire SFF COM market inside a decade confirms that SGET is pursuing the right strategy by focusing on small form factor modules and creating processor-architecture-agnostic standards to meet global needs.

Cost-effective processors demand cost-effective designs

Pricing has likely also contributed to the success of the two SGET standards. Neither uses a costly connector on the module itself, which saves on materials and assembly. Instead, both module standards leverage cost-effective MXM edge connectors, which are mass-produced for notebook graphics cards. Qseven uses the MXM-2 specification, while SMARC has adopted MXM-3. The focus on small form factors, low power, and higher packing densities also aligns well with the electronics industry’s most persisting megatrends. With module standards that consistently support these trends, SGET creates new value for the industry time and again.

Market success draws new members

The success of Qseven and SMARC, as well as the SGET’s other standardization efforts around embedded box PCs (eNUC) and edge computing logic (UIC), have also attracted many new members. The organization has grown from six founders to 50 official, active members listed on the website. The number of unofficial supporters is even larger. As a non-profit organization, SGET makes its specifications freely available to anyone. Membership is only required to use the standards and brand names (Qseven, SMARC, etc.). This openness distinguishes SGET from other standardization bodies and is one of the keys to its success. Nevertheless, official membership is crucial for further development of these and other standards. As the SGET does not want to stop at current achievements but envisages itself as a platform for creating new value through further standardization, it is actively seeking new members.

Miniaturization trend continues

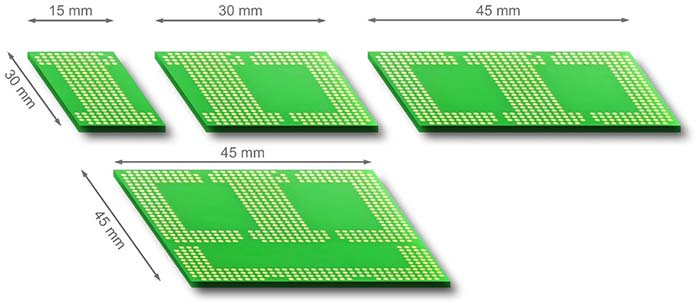

With SGET having conquered the credit-card-sized COM market for ARM and x86 application processors, the question is: “What’s next?” Even standardization bodies can’t rest on their laurels. And SGET is living up to the challenge, offering yet more pins in a yet smaller footprint in the new Open Standard Module (OSM) specification. First introduced in 2020 and available in specification 1.1 since mid-2022, OSM offers four sizes that are all smaller than SMARC or µQseven. Even the largest 45 mm x 45 mm OSM module is 28% smaller than µQseven and 51% smaller than SMARC yet offers 662 pins. The other OSM footprints are even more compact: OSM Size-0 (Zero) is the smallest form factor at 30 mm x 15 mm with 188 BGA pins. OSM Size-S (Small) measures 30 mm x 30 mm with 332 pins, and OSM Size-M (Medium) offers 476 pins on 30 mm x 45 mm. With this new specification, SGET is capturing the relentless progress toward packing more functionality and higher density into the same space.

OSM ushers in a new generation of COMs

As SGET standards have evolved, module footprints have decreased in size while packing density has increased.

With OSM, SGET adds a major new benefit to the list of COM advantages: support for SMT assembly. It is why SGET brands OSM as a second-generation (Gen2) COM standard. For OEMs, this innovation enables significant cost savings for packaging, assembly, and testing in high-volume production. Whether OSM will establish itself worldwide as the premier Gen2 COM standard remains to be seen in these early days. However, with an open, scalable, manufacturer-agnostic specification for SMT-compatible COMs that is already backed by embedded computing leaders, SGET looks poised to replicate the success it has achieved in the past with SMARC and Qseven.

Major manufacturers officially support OSM

SGET members Advantech, Aries, Avnet, F&S, Geniatech, iesy, iWave, and Kontron are the first manufacturers to deliver official OSM modules, with an ecosystem rapidly developing around them. The first carrier board developers are already advertising OSM support in addition to classic COMs, and manufacturers such as iWave and Yamaichi have released OSM test adapters. Application-ready Gen2 COMs using the OSM standard are already available in multiple variants:

| OSM vendor support of processors | Advantech | Aries | Avnet | F&S | Geniatech | iesy | iWave | Kontron | Yamaichi Electronics |

| ESP32 Xtensa | x | ||||||||

| Intel Atom (Elkhart Lake, Apollo Lake) | x | ||||||||

| NXP i.MX 8M Mini | x | x | x | x | x | ||||

| NXP i.MX 8M Nano | x | ||||||||

| NXP i.MX 8M Plus | x | x | x | ||||||

| NXP i.MX 8ULP | x | x | |||||||

| NXP i.MX 8X Lite | x | ||||||||

| NXP i.MX 91 | x | x | |||||||

| NXP i.MX 93 | x | x | x | x | |||||

| Qualcomm Snapdragon QCS6490 | x | ||||||||

| Renesas RZ/A3UL | x | ||||||||

| Renesas RZ/Five | x | x | |||||||

| Renesas RZ/G2L | x | ||||||||

| Renesas RZ/G2UL | x | x | |||||||

| Rockchip PX30 | x | ||||||||

| Rockchip RK35 | x | ||||||||

| STM32MP13x | x | x | |||||||

| Test socket | x | x | |||||||

| TI AM33x Sitara | x | ||||||||

| TI AM62Ax Sitara | x | ||||||||

| TI AM62x Sitara | x |

Table 1: Source: SGET e.V.

Interested companies are invited to request a roadmap for the support of additional processors. The new OSM Design Guide 1.0 and OSM Specification 1.1 are both available as free downloads on the SGET website.

It will be interesting to see what task SGET tackles next. Anyone wishing to stay up to date on the latest developments can subscribe to SGET’s newsletter via their website. According to SGET Chair Ansgar Hein, new standardization efforts around FPGAs are already underway. The exploratory phase is complete, a team mission statement is in place, and a concrete proposal for an open FPGA standard exists. So, all signs are pointing to SGET forming a new Standard Development Team (SDT). This would be the sixth standard under its umbrella.

[i] https://www.gminsights.com/industry-analysis/system-on-module-market

[ii] https://www.gminsights.com/industry-analysis/system-on-module-market

[iii] https://www.astuteanalytica.com/industry-report/computer-on-module-market

[iv] https://www.gminsights.com/industry-analysis/system-on-module-market